Businesses donating meals stock which are qualified for the prevailing Improved deduction (for contributions with the treatment in the ill, needy and infants) may perhaps qualify for enhanced deduction restrictions. For contributions built in 2021, the Restrict for these contribution deductions is elevated from fifteen% to 25%. For C organizations, the twenty five% Restrict relies on their taxable income.

each and every donation has meaning, but by maximizing your tax benefits, you can ensure you are supplying as much as possible to the will cause that issue to you personally. Which system can help you do by far the most fantastic?

The IRS assumes that a hundred% of your respective payments originate from the highest attainable tax team right up until that equilibrium is exhausted. Then the income is drawn from another greatest tax category.

providing your donation just ahead of or perhaps once the New calendar year may well imply a substantial difference with your tax bill. The improve may not issue much to you personally, but That is worthy of noting. Understand that itemized charitable tax deductions are limited and can't decrease your whole income tax load.

supplying to charity not merely helps make a beneficial philanthropic influence but might also positively influence your tax burden.

experienced professional medical bills. professional medical expenses in surplus of ten% of altered gross income (AGI) can qualify being an itemized deduction

For over two a long time, we've read a steady drumbeat of reports highlighting inflation and its effect on desire premiums. The correlation appears obvious, but The difficulty is definitely extra complicated.

Ordinarily, people who elect to go ahead and take common deduction cannot declare a deduction for his or her charitable contributions. The regulation now permits these people today to assert a constrained deduction on their 2021 federal income tax returns for money contributions created to selected qualifying charitable companies.

You will find there's Specific rule letting enhanced deductions by organizations for contributions of foodstuff inventory with the care in the unwell, needy or infants. the level of charitable contributions of foods stock a business taxpayer can deduct under this rule is limited to a proportion (generally 15 per cent) on the taxpayer’s aggregate Review Internet income or taxable income.

Patch has partnered with Feeding America to assist increase awareness on behalf of the millions of Americans going through hunger. Feeding The united states, which supports 200 foods banking companies across the nation, estimates that in 2021, much more than forty two million People in america received’t have adequate nutritious foodstuff to try to eat due to the consequences of your coronavirus pandemic. it is a Patch social great challenge; Feeding America receives 100% of donations.

eradicating significant-progress property out of your estate will help constrain how massive your taxable estate gets to be as time passes.

Homeownership guideManaging a mortgageRefinancing and equityHome improvementHome valueHome coverage

The charitable contributions deduction will allow taxpayers to deduct donations of money and assets provided to skilled charitable organizations.

From Social protection to IRAs and investments, with intelligent tax setting up, retirees might have some Regulate around how much in their income they'll get to keep.

Jurnee Smollett Then & Now!

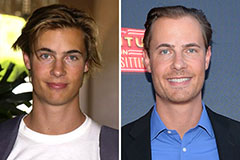

Jurnee Smollett Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!